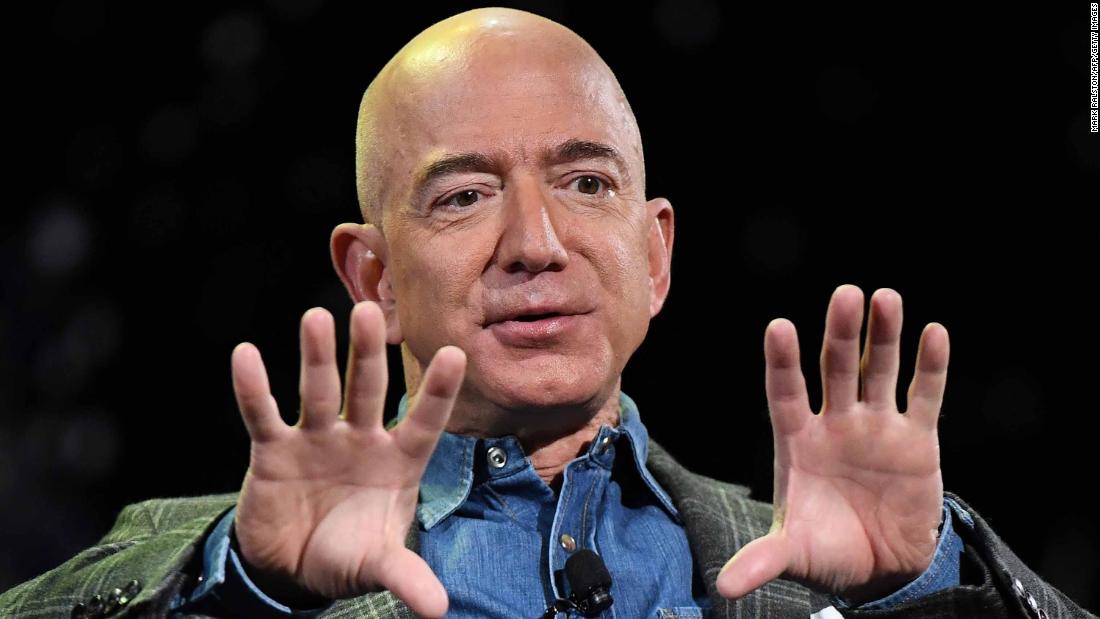

Jeff Bezos got his phone hacked, perhaps by Saudi Arabia. But that might be the least of his problems.

Amazon (AMZN) is facing a host of calls from both Republicans and Democrats for stricter regulation of the company and perhaps an antitrust investigation.

The company is embroiled in a legal battle against the United States after the Trump administration passed over Amazon Web Services for a $10 billion cloud computing contract called JEDI.

And Amazon's holiday season was shortened by a later-than-usual Thanksgiving. It's expected to post relatively lackluster fourth-quarter earnings growth.

Wall Street analysts expect Amazon's sales to have grown 17% last quarter, according to a survey by Refinitiv. That'd be good for most companies, but far less than the 35% average growth Amazon posted over the past four years in the holiday quarter.

Despite Amazon's strong online sales during the holidays, some analysts remain concerned that the overall quarter might have been lighter than usual (See: Target's considerably worse-than-expected holiday quarter.)

Profit growth from Amazon's enormous cloud operation has also slowed. "Meh" earnings for Amazon would cap off a particularly bad stretch for the company.

Microsoft's victory (for now, anyway, pending a trial) in attaining the JEDI contract puts the company "in the catbird's seat to get more of these complex workloads" in the future, according to Dan Ives, analyst at Wedbush Securities.

Meanwhile, the bad news continues to pile up for Bezos & Co.

"We expect the antitrust rhetoric to reach deafening levels during this Presidential election year, while Amazon's relationship with the White House remains the most precarious within Big Tech," said Brian White, internet and software analyst at Moness Crespi Hardt in a note to investors this week.

Waning optimism about the American labor market

The American labor market is chugging along, adding hundreds of thousands of new jobs each month. Other indicators are positive too: The number of people filing for unemployment benefits remains historically low, as does the unemployment rate.

But economic growth in the United States is expected to slow in 2020 compared to last year, and that somewhat weaker forecast is starting to feed through into hiring expectations.

Just over half — 51% — of companies plan to hire new workers this year, according to a recent survey conducted by Challenger, Gray & Christmas, an outplacement firm. That's down from 55% that said at the end of 2018 they would be adding heads in 2019.

Although that's far from dreadful, it's a sign that companies are less optimistic about the economy this year. More than 18% of companies surveyed reported that economic fears and soft demand would hurt their ability to hire, up from 9% a year earlier.

"We are seeing some indicators, such as slow-growing wages, an increase in job cuts, and an exodus of CEOs, that may portend rough waters ahead," said Andrew Challenger, the firm's vice president.

Economists remain bullish on the US economy, but weakness in American factories because of the trade war has proven detrimental to growth.

"It is not a exaggeration to say this is the strongest labor market in history, however, economic growth continues to slow and let's not forget that manufacturing is in a recession," said Chris Rupkey, chief financial economist at MUFG.

Somewhere, Elizabeth Warren is smiling

Thursday was a good day for proponents of Wall Street reform.

Goldman Sachs CEO David Solomon announced that the firm wouldn't take any companies public unless they had at least one woman on the board. By next year, Goldman will up its requirements to two women. Diversity is a good moral goal, but Solomon offered a business rationale for the decision: Companies with women on their boards have outperformed companies with all-male boards, he said.

Later Thursday, the US Office of the Comptroller of the Currency fined eight former Wells Fargo executives a total of nearly $60 million in connection with the banks accounts and sales scandals. Former CEO John Stumpf agreed to a lifetime ban from the banking industry and a $17.5 million fine for his role in the misconduct.

Advocates for bank reform, most notably Democratic presidential candidate and US Senator Elizabeth Warren, have long sought punishment for Wells Fargo executives and for bank leadership to be more inclusive. On Thursday, they got a double win.

American Express and Ericsson report earnings before US markets open.

Also today: US Purchasing Managers' Index data arrives for January, providing fresh evidence on the health of the US manufacturing and services sectors.

Coming next week: The Federal Reserve is expected to stay on hold, but the Bank of England could cut interest rates ahead of the UK's departure from the European Union.

https://news.google.com/__i/rss/rd/articles/CBMiTGh0dHBzOi8vd3d3LmNubi5jb20vMjAyMC8wMS8yNC9pbnZlc3RpbmcvcHJlbWFya2V0LXN0b2Nrcy10cmFkaW5nL2luZGV4Lmh0bWzSAVBodHRwczovL2FtcC5jbm4uY29tL2Nubi8yMDIwLzAxLzI0L2ludmVzdGluZy9wcmVtYXJrZXQtc3RvY2tzLXRyYWRpbmcvaW5kZXguaHRtbA?oc=5

2020-01-24 12:00:00Z

52780566934792

Bagikan Berita Ini

0 Response to "Jeff Bezos has bigger problems than his phone getting hacked - CNN"

Post a Comment